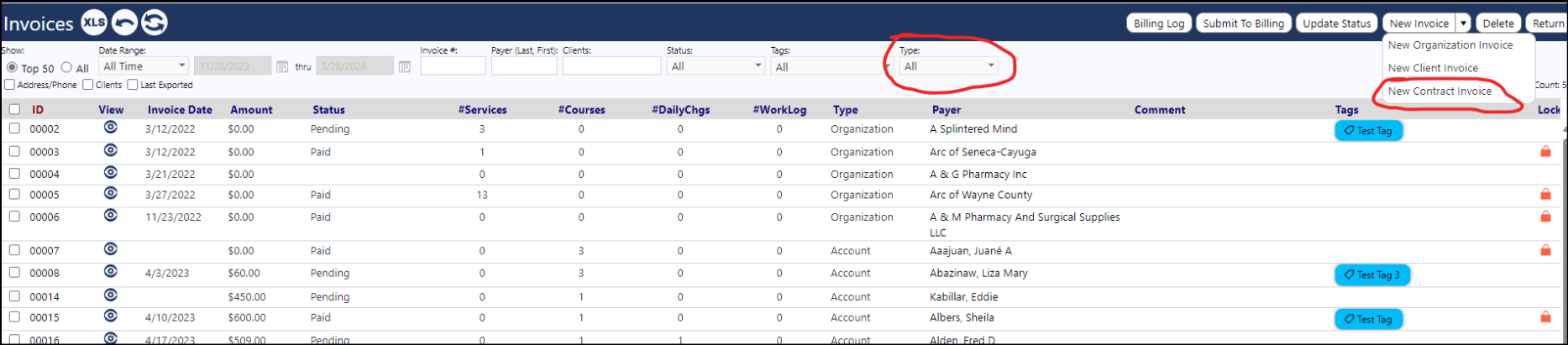

Invoices can now be attached to contracts via the Invoice page (Finance > Financial Accounts > Invoices):

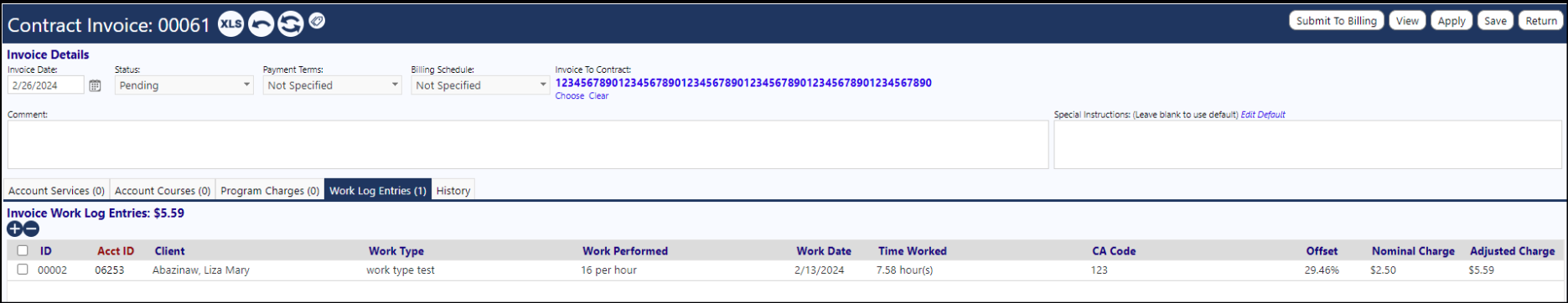

You can invoice for the items which are on the work log. The Contract Invoice will calculate a final cost of how much the client is to be paid. When you add the work log items to the invoice, the chooser only shows work log entries for the contract you're invoicing for.

The price calculation works slightly differently whether the work was done per hour or by number of pieces

- Per hour: nominal charge * number of hours worked * productivity rate

- Nominal charge: the base or training rate. On the work log, if you checked off training rate, then it'll use the training rate

- Number of hours worked: value in the time worked column. This is the time difference between the start and end time on the work log, with lunch deducted if specified. This value will not go below 0 minutes

- Productivity rate: the client's most recent wage test score for the given work type at the time the work was done. This is what's shown in the offset column

- You can derive adjusted charge in the above screenshot, for example: $2.50 * 7.583333... (it was 7 hours 35 minutes) = $18.95 * 29.46% = $5.585124... = $5.59

- Pieces: nominal charge * (work performed / nominal quantity) * productivity rate

- Nominal charge: same as before

- Work performed: how many pieces of work the client performed on this work log entry

- Nominal quantity: how many pieces defines one "unit" of work. This is defined on the contract, when editing a work type attached to the contract. For example, the contract could define that doing 100 pieces of work is worth $5.50. But if someone is logged doing 120 pieces of work, then they would make 1.2x the rate, in this case $6.60

- Productivity rate: same as before

- If, in the screenhot above was 16 pieces, and the nominal quantity was 15 pieces, you could derive the adjusted charge like this: 16 pieces / 15 pieces = 1.0666666... * $2.50 = $2.6666666... * 29.46% = $0.7856 = $0.79

Note: if you end up invoicing for a work type that "cannot be used on contracts" (like on vacation, out sick, etc.) that isn't a work type actually on the chosen contract, it'll use that work type's default values for base rate, default rate, and quantity from the work type library in these calculations.

These work types should be setup with a base and training rate of $0

The way it's built now, it calculates the adjusted charge at the time the work log entry is added to the invoice, and it also calculates what productivity score to use.

The rate and quantity come from the contract. The rate used should be the rate in effect at the time of the work being performed, not the time of when the work was billed.

The work performed comes from the work log depending on mode:

- Per hour - auto-calculate the number of minutes difference between start and end time, optionally subtract 30 minutes lunch, then convert that to the number of hours as a decimal

- Per piece - just use the number entered on the work log

Some examples of invoicing:

- Example 1: using the base rate of $1/Hr, a nominal quanity of 3 hours, and the hours 10AM - 4:30PM without lunch on the work log (so 6.5 hours), we'd calculate the invoice as $1/ Hr * (6.5 / 3)Hrs = $2.1666666...(or $2.17) (or 2.16 based on rounding).

- Example 2: using the base rate of $4, a nominal quantity of 54 pieces, and entering 100 pieces on the work log, we'd invoice for $4/unit * (100 / 56) units = $7.14.

Once a work log entry is attached to an invoice, it becomes locked and you cannot edit it or delete it.

You can also create an invoice from the work log page by selecting multiple work log entries and using the create invoice button.